Payroll system

Manage your payroll and wage calculations, with integrated HR records and high value reports with the payroll system.

Company details

- Tax details e.g. VAT number

- Division / departments setup

- Edit / modify details

- Follow-through to Payslips / paystubs

- Start date

Compliance

- Import / export details into the payroll software

- Export tax related information for submission to SARS

- Employee bank details export

- Audit

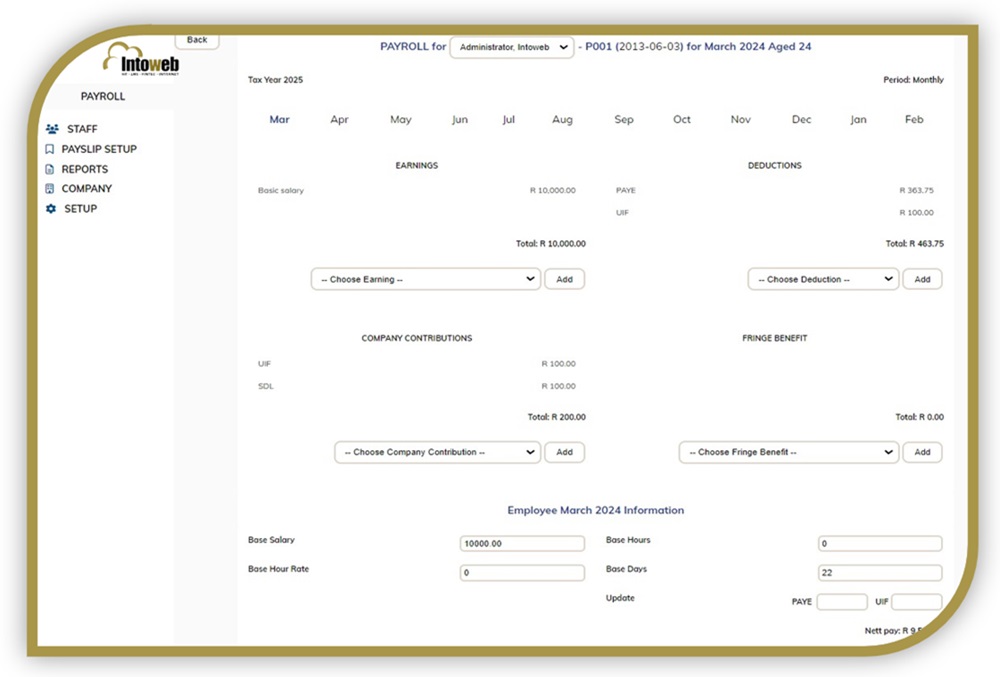

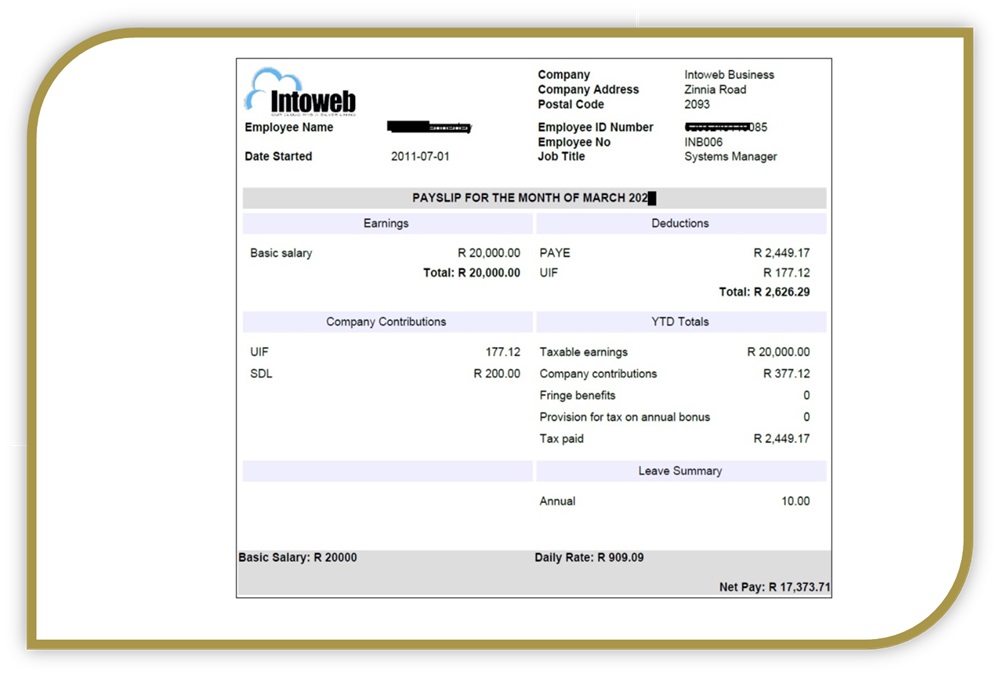

Setup of payslips

- Multiple pay-runs

- Company branding

- Add in specific fields

- Employee details

- Department / Division

Wage calculations on the payroll system

- PAYE, SDL, UIF

- According to South African SARS requirements

- EMP 201 reports

- Attendance and leave integration into payslips

- Additional fields

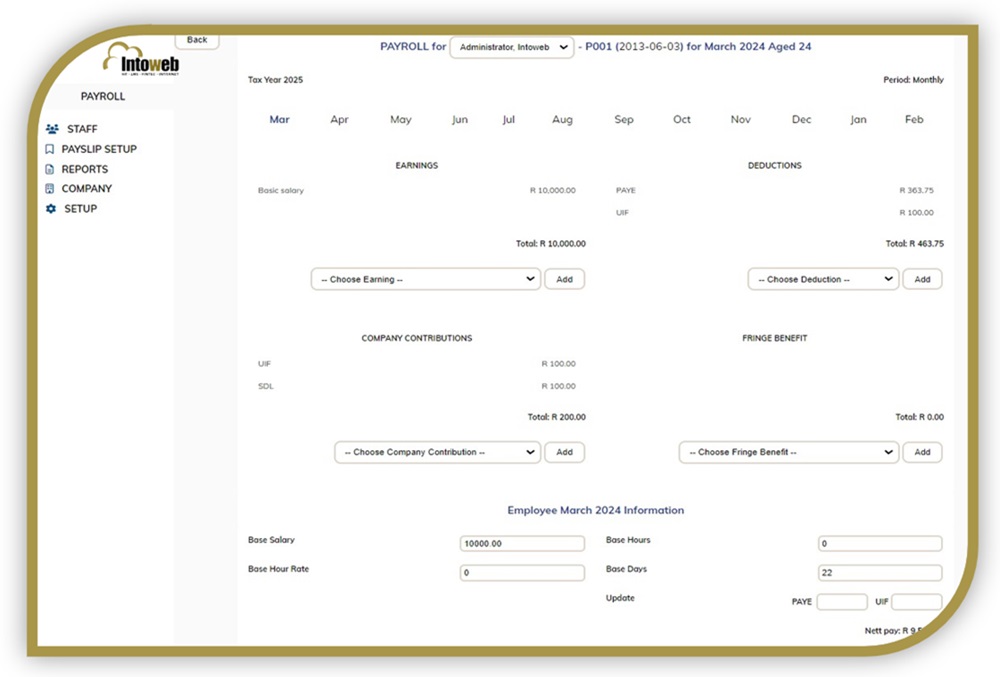

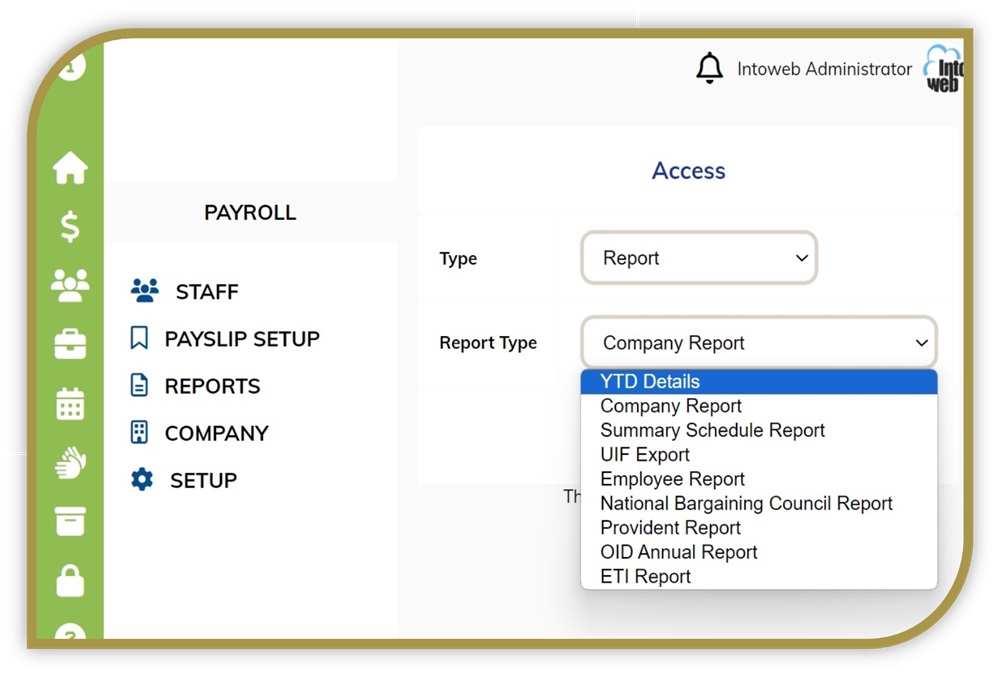

Records and Reports

- Auditable record keeping

- Employee wage calculations

- Company total report

- YTD, UIF, Employee report, Provident, OID, ETI

FAQ about the Intoweb Payroll Software

Can I customize fields?

Fields in the payroll software required by law are automatically there, while fields specific to the company can be added by the company payroll administrator.

Does the payroll system follow SARS regulations?

Yes, SARS information such as UIF, SDL are automatic, and tax tables are updated yearly at the beginning of the fiscal year.

Does the payroll system integrate into HR and Leave Management software?

It is fully integrated with the Intoweb HR and Leave software

Payroll software:

- SARS compliance

- Saves time

- Continuity

- Customisation to company

- Accessibility increases online. Payroll can be done easily, anytime by the authorised persons

- Reduces manual errors and inaccuracies

- Data security – No more payslips dropping off a desk